Major Direct tax proposals (from speech)

👉 1. Rollout of next gen ITR form

👉 2. New limit for 44AD (Traders & Manufacturers)& ADA(Specified Professionals) : 3 crore & 75 Lacs

👉 3. Expense deduction to MSME to be allowed on payment basis

👉 4. New cooperatives manufacturing tax @ 15% if upto 31.03.24

👉 5. Higher loan limit /cash deposit Rs 2 lacs for PAC society -RDB

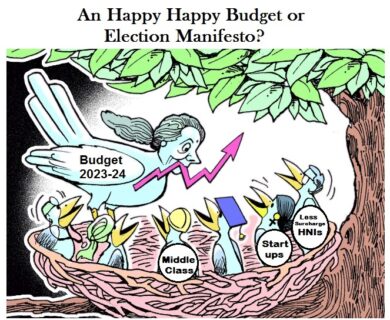

👉 6. Startups:

a) Date of incorporation for. startup extended to 31.03.24

b) Extension of CF losses 7 yrs in case of change in shareholders

👉 7. Selective scrutiny + More CIT to dispose off small appeals

👉 8. Extension of tax benefits for IFSC

👉 9. Personal Income tax

a) Tax rebate limit extended to 7 lacs (new regime)

b) change in tax slabs & new tax rates

0-3 L : Nil

3-6 L : 5%

6L-9L : 10%

9L-12L: 15%

12-15 L : 20%

15L +: 30%

c) Salaried class & pensioners(incl family pensioners) :

Standard deduction extended

d) Highest surcharge reduced from 37% to 25%

Now MMTR : 39%

e) Leave encashment exemption (pvt) increased from 3Lacs to 25 Lacs

f) New tax regime is now default tax regime -Old tax regime